Quicken software isn’t just another budgeting app; it’s your all-in-one personal finance command center. Think of it as your digital financial advisor, helping you manage everything from checking accounts and credit cards to investments and taxes. Whether you’re a seasoned investor or just starting to manage your money, Quicken offers a range of tools and features designed to simplify your financial life and help you reach your goals.

From basic budgeting to advanced investment tracking, Quicken adapts to your needs, offering various versions tailored to different levels of financial expertise.

This guide dives into the world of Quicken, exploring its user-friendly interface, powerful budgeting tools, robust investment tracking capabilities, and much more. We’ll cover everything you need to know to get started and maximize Quicken’s potential to help you take control of your finances.

Quicken Software Overview

Quicken is a popular personal finance software application designed to help individuals and families manage their money more effectively. It offers a range of tools for budgeting, tracking income and expenses, managing investments, and paying bills, all in one convenient location. While its interface has evolved over the years, the core functionality remains focused on simplifying the often-complex task of personal financial management.Quicken provides a centralized system for tracking financial information, offering a clearer picture of your overall financial health than relying on spreadsheets or disparate bank statements.

This allows users to identify spending patterns, set financial goals, and make informed decisions about their money. Its ease of use, compared to manual methods, is a significant advantage for many users.

Quicken Software Versions and Features

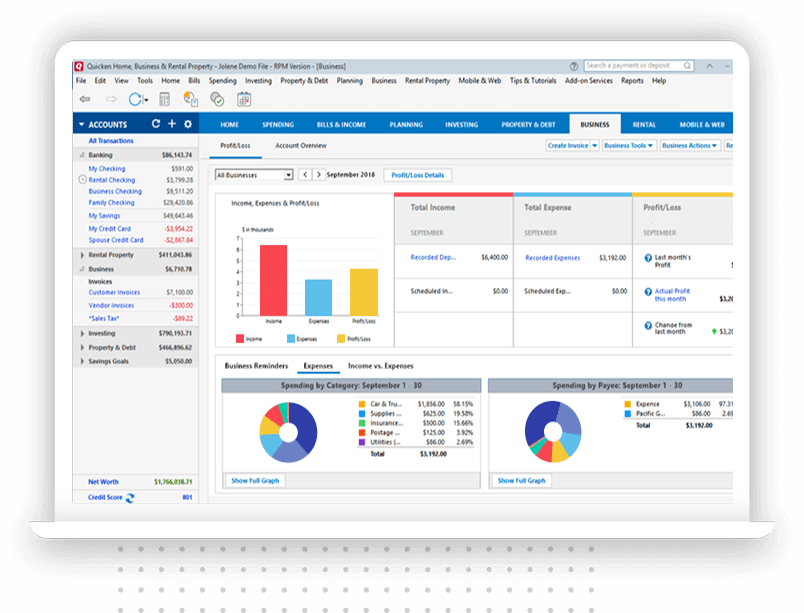

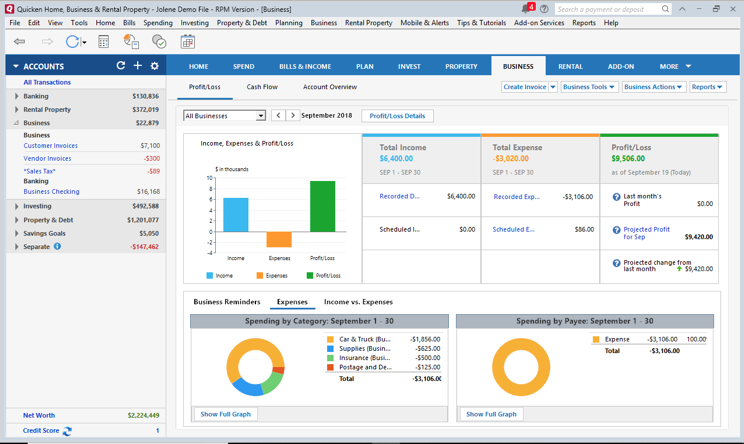

Quicken offers several versions of its software, each tailored to different user needs and financial complexities. The primary versions cater to individual users, families, and small businesses. Key features vary across these versions, reflecting the increasing sophistication of financial management requirements. For example, Quicken Deluxe typically includes features for budgeting, bill payment, and investment tracking, while Quicken Premier adds more advanced investment management tools, such as portfolio analysis and tax reporting.

Quicken Home & Business is geared towards self-employed individuals and small businesses, providing tools for managing business income and expenses separately from personal finances. The features offered in each version are designed to provide users with the specific tools necessary for their financial circumstances.

Quicken Compared to Other Personal Finance Software, Quicken software

Several other personal finance software options compete with Quicken, each with its own strengths and weaknesses. Mint, for example, is a free online service that offers basic budgeting and tracking features, but lacks the advanced investment management capabilities of Quicken Premier. YNAB (You Need A Budget) emphasizes budgeting and goal setting, with a unique approach to managing cash flow.

Personal Capital is another strong competitor, offering robust investment tracking and retirement planning tools, but it may be less intuitive for users who are new to personal finance software. The choice of software ultimately depends on individual needs and preferences. Some users might prefer the comprehensive features of Quicken, while others might find a simpler, free option like Mint sufficient for their needs.

The level of investment management features required also heavily influences the choice.

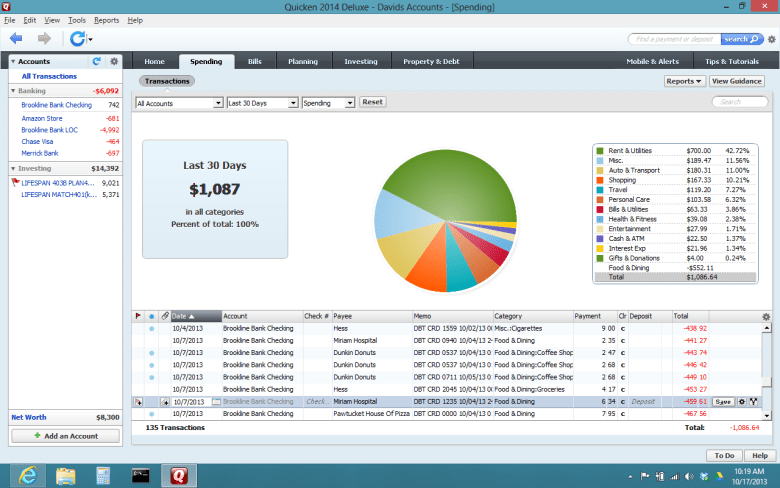

User Interface and Experience

Quicken’s user interface is a bit of a mixed bag. While generally intuitive for basic tasks, its complexity can be overwhelming for first-time users or those tackling more advanced features. The software has evolved over time, resulting in a design that sometimes feels a little patchwork, with elements that don’t always integrate seamlessly. However, its strengths lie in its clear categorization of financial data and the overall functionality it offers.The ease of use and navigation in Quicken depend heavily on the user’s familiarity with personal finance software and the specific tasks they’re trying to accomplish.

For simple tasks like recording transactions or viewing account balances, the interface is relatively straightforward. However, navigating more complex features, such as investment tracking or tax reporting, can be challenging due to the sheer volume of options and menus. Many users find themselves relying heavily on Quicken’s extensive help documentation or online resources.

User Flow Diagram: Reconciling a Bank Account

The following describes a common user flow for reconciling a bank account within Quicken. Imagine a user named Sarah needs to reconcile her checking account.Sarah begins by selecting her checking account from the account list displayed on the Quicken home screen. This list usually shows account balances and potentially flags any accounts needing attention. She then clicks on the “Reconcile” button, usually located near the top of the account details page.

This opens the reconciliation window. Quicken presents Sarah with a list of transactions downloaded from her bank, compared to the transactions she has already recorded in Quicken. She reviews each transaction, marking them as “Cleared” if they match both records, or investigating discrepancies. If a transaction is missing from either record, she can manually add it. After reviewing all transactions, she confirms the reconciliation, and Quicken updates the account balance to reflect the reconciled amount.

If there are significant discrepancies, Quicken might highlight them and suggest potential reasons for the difference, such as pending transactions or bank errors. The entire process is guided by clear on-screen instructions and prompts within the software.

Budgeting and Financial Planning Features: Quicken Software

Quicken offers a robust suite of tools designed to help you take control of your finances, from creating detailed budgets to tracking your net worth. It moves beyond simple expense tracking, providing powerful features for proactive financial planning and goal setting. This allows you to not just see where your money is going, but also to actively shape where it goes in the future.Quicken facilitates budgeting and financial planning through its integrated system for tracking income, expenses, and net worth.

It allows for the creation of customized budgets based on your individual financial goals and circumstances, providing visual representations of your spending habits and helping you identify areas for potential savings. Furthermore, Quicken’s ability to link to your bank accounts and credit cards automates much of the data entry, significantly reducing the time and effort required for financial management.

Income and Expense Tracking

Quicken simplifies the process of tracking income and expenses. You can manually enter transactions or link your bank and credit card accounts for automatic updates. The software categorizes transactions, allowing you to easily see where your money is going. Detailed reports provide a clear picture of your spending habits, highlighting areas where you might be overspending. For example, you might discover that dining out contributes significantly to your monthly expenses, prompting you to adjust your budget accordingly.

Customizable categories allow for highly personalized tracking; you can create categories like “Groceries,” “Entertainment,” or “Transportation,” and even subcategories like “Gas” under “Transportation.” This granular level of detail provides valuable insights into your spending patterns.

Net Worth Tracking

Tracking your net worth is crucial for understanding your overall financial health. Quicken simplifies this process by allowing you to input assets (like checking and savings accounts, investments, and property) and liabilities (like loans and credit card debt). The software automatically calculates your net worth, providing a clear snapshot of your financial position. This feature is particularly helpful for monitoring progress towards long-term financial goals, such as saving for a down payment on a house or retirement.

For instance, if your goal is to save $20,000 for a down payment within two years, you can track your net worth regularly to monitor your progress and adjust your savings strategy as needed.

Setting Up a Budget in Quicken: A Step-by-Step Guide

Setting up a budget in Quicken is straightforward. First, you need to ensure that your accounts are linked and your transactions are categorized. Then, follow these steps:

- Navigate to the Budgeting Section: Locate the budgeting section within the Quicken interface. The exact location may vary slightly depending on your Quicken version, but it’s generally easily accessible from the main menu or sidebar.

- Create a New Budget: Choose the option to create a new budget. You’ll likely be presented with several budgeting templates or the option to create a custom budget from scratch.

- Define Income Sources: Input your income sources, specifying amounts and frequency (e.g., monthly salary, bi-weekly paycheck, freelance income).

- Allocate Funds to Categories: Assign amounts to different expense categories based on your spending habits and financial goals. You can use the pre-defined categories or create custom ones to match your specific needs.

- Review and Adjust: Once you’ve allocated funds, review your budget to ensure it aligns with your financial goals. Make adjustments as needed to achieve a balanced budget.

- Monitor and Track: Regularly monitor your budget to ensure you stay on track. Quicken will provide visual representations and reports to highlight areas where you might be overspending or underspending.

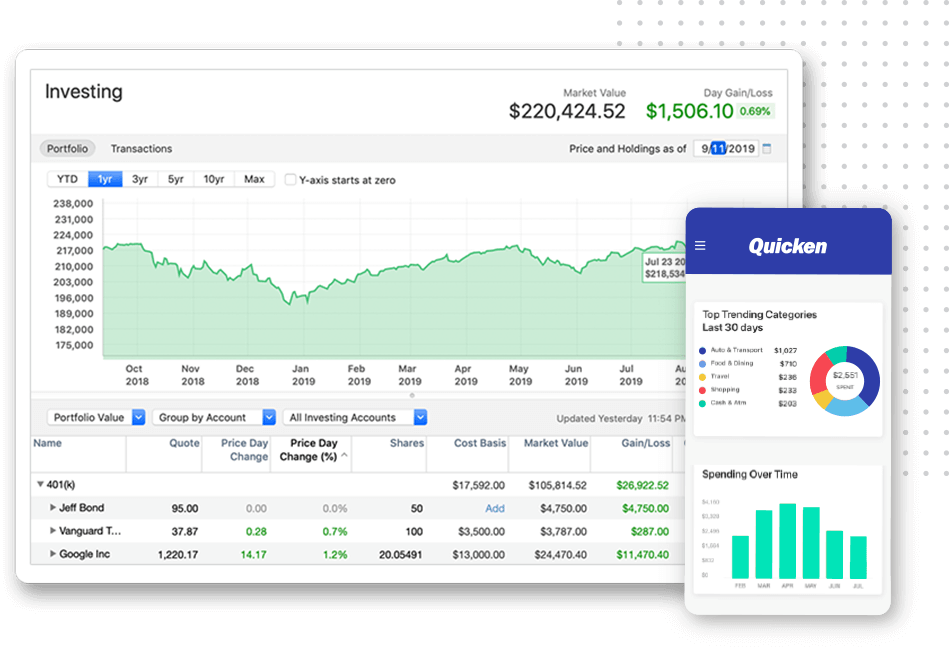

Investment Tracking and Reporting

Quicken offers robust tools for tracking your investments, providing a comprehensive overview of your portfolio’s performance. It goes beyond simply recording transactions; Quicken analyzes your investments, offering insights into growth, diversification, and potential risks. This allows for more informed financial decisions and proactive portfolio management.Quicken’s investment tracking capabilities are extensive, enabling users to monitor various aspects of their holdings.

The software automatically downloads transaction data from many brokerage accounts, saving significant time and effort. It then categorizes and organizes this data, making it easy to view your holdings across different accounts and asset classes. Beyond simple tracking, Quicken generates customizable reports to visualize your investment performance over time.

Supported Investment Account Types

Quicken supports a wide array of investment accounts, ensuring compatibility with most investment strategies. The software handles various account types, including brokerage accounts, retirement accounts (401(k)s, IRAs), and education savings plans (529 plans). It also accommodates different investment vehicles, such as stocks, bonds, mutual funds, ETFs, options, and real estate. The ability to track diverse investments within a single platform simplifies portfolio management and analysis.

Quicken Investment Tracking Features Compared to Personal Capital

| Feature | Quicken | Personal Capital |

|---|---|---|

| Account Linking | Supports many brokerage accounts via direct download; manual entry also possible. | Supports many brokerage accounts via direct download; manual entry also possible. |

| Transaction Categorization | Automatic categorization with manual override options. | Automatic categorization with manual override options. |

| Performance Reporting | Provides various customizable reports, including performance summaries, asset allocation, and tax implications. | Offers comprehensive performance reporting with visualizations and detailed breakdowns. |

| Portfolio Analysis | Analyzes asset allocation, diversification, and risk exposure. | Provides in-depth portfolio analysis, including risk assessment and diversification suggestions. |

Debt Management Tools

Quicken offers a robust suite of tools designed to help you conquer your debt and achieve financial freedom. It goes beyond simply tracking payments; it provides the framework to actively manage and strategically reduce your debt burden. The software’s intuitive design makes even complex debt strategies accessible and manageable.Quicken helps users manage debt and track payments through its integrated system for recording transactions and categorizing expenses.

By linking your bank accounts and credit cards, Quicken automatically imports transaction data, eliminating the need for manual entry. This automated tracking provides a real-time view of your debt balances, minimum payments, and interest accrued. You can easily see where your money is going and identify areas where you might be overspending. Furthermore, Quicken allows for the detailed categorization of debt payments, making it simple to monitor progress and identify trends.

Debt Reduction Plan Creation

Quicken facilitates the creation of personalized debt reduction plans by providing tools to analyze your debt situation. Users can input their outstanding balances, interest rates, and minimum payments for each debt. The software then allows you to explore various debt repayment strategies, such as the debt snowball or debt avalanche methods. Based on your input, Quicken projects how long it will take to pay off your debts under each scenario, providing detailed breakdowns of total interest paid and the overall cost of each approach.

This feature allows for informed decision-making, empowering users to choose the most effective strategy for their specific financial circumstances. For example, a user with multiple credit cards could compare a debt snowball approach (paying off the smallest debt first for motivational purposes) versus a debt avalanche approach (paying off the debt with the highest interest rate first for financial efficiency).

Quicken will clearly display the projected timelines and total interest paid for both strategies, allowing the user to choose the best option.

Debt Repayment Strategy Simulation

Quicken’s simulation capabilities enable users to experiment with different debt repayment strategies without affecting their actual finances. By adjusting variables such as extra payments, interest rates, or payment schedules, users can see the impact of these changes on their overall debt repayment timeline and total interest paid. This “what-if” analysis allows for informed decision-making and helps users identify the most efficient and cost-effective approach to debt reduction.

For instance, a user could simulate the impact of allocating an extra $200 per month towards their highest-interest debt. Quicken would then update the projected payoff date and the total interest saved, allowing the user to assess the feasibility and benefit of such a strategy. This feature empowers users to actively participate in their debt reduction journey, enabling them to adjust their strategy as needed and stay on track towards financial goals.

Tax Preparation Integration

Quicken doesn’t directly prepare your taxes, but it significantly streamlines the process by organizing your financial data and generating reports compatible with popular tax software. This integration saves you time and reduces the risk of errors when filing. Think of it as your financial data’s pre-flight checklist before it heads off to tax season.Quicken integrates with various tax preparation software and services, allowing for a smooth transfer of your financial data.

This automated data transfer minimizes manual data entry, a common source of errors in tax preparation. The specific methods for exporting data vary slightly depending on the tax software you use and the version of Quicken you have, but the general principles remain consistent. The key is to leverage Quicken’s built-in reporting features to generate the necessary information in a format easily imported by your tax software.

Quicken’s Tax-Related Reports and Data

Quicken can generate a variety of reports useful for tax preparation. These reports consolidate relevant financial information, simplifying the process of gathering the necessary documentation. For example, you can generate reports detailing investment income, capital gains and losses, charitable contributions, business expenses (if applicable), and itemized deductions. The specific reports available might vary slightly depending on your Quicken version and subscription level.

These reports provide a comprehensive overview of your finances, making tax preparation far less daunting. Imagine having all your income and expense information neatly organized – a lifesaver during tax season!

Exporting Quicken Data for Tax Purposes

The process of exporting Quicken data for tax purposes generally involves a few simple steps. First, ensure your Quicken data is up-to-date and accurately reflects your financial transactions throughout the tax year. Next, select the appropriate report type within Quicken, such as the “Investment Income Report” or “Deduction Report,” choosing the relevant tax year. Finally, export the report in a compatible format, such as a CSV file (Comma Separated Values) or a QFX file (Quicken Financial Exchange), which can then be imported into your tax preparation software.

Most tax software programs provide clear instructions on importing data from various sources, including Quicken. This direct export feature significantly reduces the manual effort involved in gathering and entering financial data for tax purposes. For instance, a user could export their investment income directly to TurboTax, eliminating the need to manually enter each transaction.

Security and Data Protection

Protecting your financial data is paramount, and Quicken employs a multi-layered approach to ensure the security and integrity of your information. This includes robust security measures, data encryption both in transit and at rest, and various options for backing up and restoring your financial data. Understanding these features and implementing best practices will significantly reduce the risk of data loss or unauthorized access.Quicken utilizes a combination of security protocols to safeguard user data.

This includes strong encryption algorithms to protect your data both while it’s being transmitted to and from Quicken servers (data in transit) and while it’s stored on your computer or Quicken’s servers (data at rest). The specific encryption methods used are regularly updated to reflect the latest industry best practices and to counter emerging threats. Furthermore, Quicken employs firewalls and intrusion detection systems to monitor network traffic and prevent unauthorized access attempts.

Regular security audits and penetration testing are also conducted to identify and address any vulnerabilities.

Data Backup and Restoration

Regular backups are crucial for protecting against data loss due to hardware failure, software malfunctions, or accidental deletion. Quicken offers several options for backing up your data. You can manually create backups by exporting your data to a file, which can then be stored on an external hard drive, cloud storage service, or another secure location. Alternatively, Quicken can be configured to automatically back up your data at set intervals.

This automated process ensures that regular backups are created without requiring manual intervention. Restoring your data is equally straightforward; simply import the backup file into Quicken. The software guides you through this process, ensuring a seamless transition to a restored data set. It’s recommended to keep multiple backups in different locations, such as a local external drive and a cloud storage service, to further mitigate the risk of complete data loss.

Securing Quicken Software and User Accounts

Protecting your Quicken installation and user account is essential for maintaining the security of your financial information. This involves employing strong, unique passwords for your Quicken account and avoiding the use of easily guessable passwords. Consider using a password manager to generate and store complex passwords securely. Keep your Quicken software updated to the latest version to benefit from the latest security patches and bug fixes.

These updates often include improvements to security features and address known vulnerabilities. Regularly review your Quicken account activity for any unauthorized access attempts or suspicious transactions. If you suspect any compromise, change your password immediately and contact Quicken support. Furthermore, ensure that your computer’s operating system and antivirus software are also up-to-date to provide an additional layer of protection against malware and other threats.

Regularly running a malware scan can help identify and remove any malicious software that might compromise your Quicken data.

So, Quicken’s great for managing personal finances, right? But for tracking and managing the maintenance of, say, a large building’s assets, you’d need something more robust, like a cmms system. Those are way more powerful than Quicken when it comes to scheduling repairs and tracking costs across multiple systems. Ultimately, Quicken is awesome for personal use, but for complex asset management, a dedicated CMMS is the way to go.

Customer Support and Resources

Quicken, like any robust financial software, understands that users will occasionally need assistance. Therefore, they provide a multi-faceted approach to customer support, aiming to empower users to resolve issues independently while also offering direct support when needed. This blend of self-service resources and direct contact options ensures a comprehensive support experience.Getting help with Quicken involves a combination of readily available online resources and direct contact with support representatives.

The goal is to provide users with the tools and information necessary to quickly resolve their issues, whether it’s a minor question or a more complex problem.

Customer Support Options

Quicken offers several avenues for obtaining customer support. These range from exploring comprehensive online resources to directly contacting support agents via phone or email. The choice of method depends on the urgency of the issue and the user’s preference for interaction. For example, a simple question about a feature might be easily answered via the online FAQ, while a critical data error might necessitate a phone call.

Available Resources

Quicken provides a wealth of self-service resources designed to help users find solutions independently. These resources are readily accessible and cover a broad range of topics. The goal is to enable users to troubleshoot common problems and understand Quicken’s features effectively without needing direct assistance.

- Extensive FAQ section: This section addresses many frequently asked questions, covering a wide array of topics from basic setup to advanced features.

- Comprehensive Tutorials and Video Guides: Quicken offers video tutorials and written guides that walk users through various aspects of the software, from importing data to creating budgets.

- Online Community Forums: Users can connect with other Quicken users in online forums to share tips, ask questions, and find solutions to problems they’ve encountered. This peer-to-peer support can be incredibly valuable.

- Knowledge Base Articles: A searchable knowledge base provides detailed articles on specific issues and features, allowing users to quickly find the information they need.

Troubleshooting Common Quicken Issues

Many common Quicken issues can be resolved by utilizing the resources mentioned above. However, here’s a list of common problems and where to find solutions:

- Data Import Problems: Check the Quicken knowledge base for articles on importing data from different sources. Tutorials on data import are also available.

- Budgeting and Reporting Errors: Review the budgeting and reporting tutorials and FAQs to ensure proper setup and data entry. The online community forums can be a helpful resource for troubleshooting specific errors.

- Software Updates and Glitches: Ensure your Quicken software is updated to the latest version. If problems persist after updating, contact Quicken support directly.

- Account Linking Issues: Refer to the FAQs or knowledge base articles related to account linking and connection troubleshooting. If the problem persists, contact Quicken support.

- Unexpected Software Behavior: Consult the online community forums to see if other users have experienced similar issues. If no solution is found, contact Quicken support.

System Requirements and Compatibility

So, you’re ready to dive into Quicken and manage your finances? Before you get started, let’s make sure your computer can handle it. Knowing your system’s specs and Quicken’s compatibility is key to a smooth, stress-free experience. We’ll cover the minimum requirements, operating system compatibility, and how to stay up-to-date with software updates.Quicken’s system requirements vary slightly depending on the specific version you’re using (Quicken Deluxe, Premier, etc.), but there are some common minimum standards.

Generally, you’ll need a reasonably modern computer to run it efficiently. Older machines might struggle, leading to slow performance or even crashes. Keeping your system updated with the latest patches and drivers will also help optimize performance and compatibility.

Minimum System Requirements

Meeting the minimum system requirements ensures basic functionality. Exceeding these specs significantly improves performance, especially when dealing with large financial datasets or complex financial modeling. For example, a faster processor and more RAM will make the software noticeably snappier, reducing wait times when accessing accounts or generating reports. A solid-state drive (SSD) will also greatly improve load times compared to a traditional hard disk drive (HDD).

Typical minimum requirements might include:

- Operating System: Windows 10 or 11 (64-bit) or macOS (specific version will vary based on Quicken version)

- Processor: Intel Core i3 or AMD equivalent or better

- RAM: 4 GB or more (8 GB recommended)

- Hard Drive Space: At least 2 GB of free space (more is recommended)

- Internet Connection: Required for online features and updates

Operating System and Device Compatibility

Quicken is primarily designed for desktop computers running Windows and macOS. While there might be mobile apps offering limited functionality (like checking balances), the full suite of Quicken features is generally only available on the desktop versions. The software is not designed to run on tablets or Chromebooks. Quicken does not offer a Linux version. Therefore, users on these platforms would need to rely on alternative personal finance software.

The specific versions of Windows and macOS supported by Quicken change over time as newer operating systems are released; it’s always recommended to check the Quicken website for the most up-to-date compatibility information before purchasing or upgrading.

Software Updates and Patches

Keeping Quicken updated is crucial for security and performance. Regular updates often include bug fixes, security patches, and new features. Quicken will usually notify you when an update is available, and you should install these updates as soon as possible. These updates address potential vulnerabilities and improve the overall stability and reliability of the software. Ignoring updates could expose your financial data to security risks or lead to compatibility issues with your bank’s online services.

Failing to update can also mean missing out on new features and improvements.

Pricing and Subscription Models

Quicken offers a range of subscription plans to cater to different user needs and budgets. Understanding the various pricing tiers and features is crucial to selecting the best option for your personal finance management. The pricing structure is designed to provide flexibility, allowing users to choose a plan that aligns with their specific requirements and level of financial complexity.

Quicken’s pricing strategy involves tiered subscription models, each offering a different set of features and functionalities. The higher-tier plans generally include more advanced tools and support, while the lower-tier plans provide a more basic level of financial management capabilities. It’s important to carefully compare the features of each plan before making a purchase decision to ensure you’re getting the best value for your money.

Quicken Subscription Plan Comparison

The following table summarizes the key features and pricing of Quicken’s subscription plans. Note that pricing and specific features may change, so it’s always best to check the Quicken website for the most up-to-date information. This information is based on publicly available data and is subject to change.

| Plan Name | Monthly Cost | Annual Cost | Key Features |

|---|---|---|---|

| Quicken Starter | $7.99 | $79.99 | Basic budgeting, bill tracking, account aggregation. Limited investment tracking capabilities. |

| Quicken Deluxe | $11.99 | $119.99 | Includes all Starter features plus advanced budgeting tools, investment tracking, and debt management features. |

| Quicken Premier | $16.99 | $169.99 | Includes all Deluxe features plus rental property management, and more robust investment tracking and reporting. |

| Quicken Home & Business | $24.99 | $249.99 | Designed for self-employed individuals and small business owners, including features for invoicing, expense tracking, and business reporting. |

Concluding Remarks

Ultimately, Quicken software empowers you to take charge of your financial future. By providing a centralized platform for managing your money, Quicken simplifies complex tasks, streamlines your financial planning, and offers valuable insights into your spending habits. While other personal finance software exists, Quicken’s comprehensive features and user-friendly design make it a top contender for anyone looking to gain control of their finances.

Whether you’re a student trying to budget, a young professional building wealth, or a seasoned investor managing a complex portfolio, Quicken offers the tools you need to succeed.

FAQ Insights

Can I use Quicken on my phone?

Quicken primarily operates on desktop computers (Windows and Mac). While there aren’t dedicated mobile apps, you can access some features through a web browser.

How secure is my data with Quicken?

Quicken employs robust security measures, including encryption and regular software updates to protect your financial information. However, it’s always best practice to use a strong password and enable two-factor authentication if available.

Is Quicken free?

No, Quicken is a subscription-based software with different pricing tiers depending on the features you need. There may be free trials available.

What if I have a problem with the software?

Quicken offers various customer support options, including online help, FAQs, and phone support. Their website is a great resource for troubleshooting common issues.

Can Quicken help me with taxes?

Quicken can generate reports that are helpful during tax season, providing a summary of your income and expenses. However, it doesn’t directly file your taxes.